How a Family Office Reduces the Complexity of Your Wealth

July 25, 2023 by Interchange Capital Partners

By Ahmie Baum, CFP® CFBA

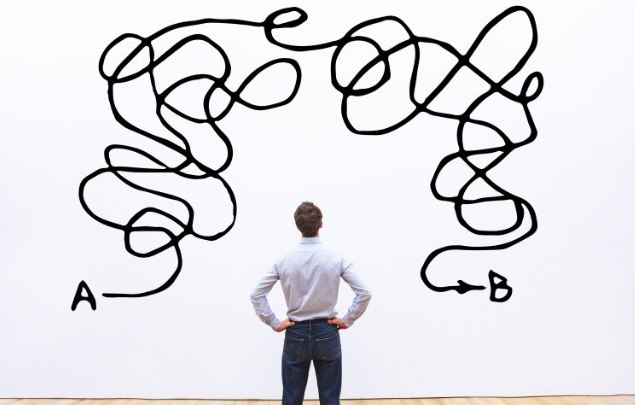

The number of tasks, information, and people that accompany wealth overwhelms many people. The complexity of family, wealth management, estate planning, tax optimization, and philanthropy demands expert guidance and meticulous attention to detail.

This is where a family office can make a significant difference.

What is a family office?

The Interchange Capital Partners family office is a private wealth management advisory firm created to address various financial, administrative, and lifestyle needs of families. Some of the key issues and challenges our family office aims to solve include:

- Wealth management and preservation: If you have substantial assets and investments, our family office can help manage and grow your wealth while preserving it for future generations. We provide personalized investment strategies tailored to your financial goals and risk tolerance using our SLG™ approach.

- Holistic financial planning: We offer comprehensive financial planning services that help with tax planning, estate planning, charitable giving, risk management, and more, ensuring all aspects of your financial life are carefully considered.

- Privacy and confidentiality: We value your privacy and prioritize protecting sensitive financial information. Our family office can provide a discreet and confidential environment for managing your affairs.

- Coordination of financial professionals: You have multiple advisors, and we act as the central point of contact, coordinating these professionals to keep everyone working toward your common financial objectives, using our state-of-the-art communication and organization system.

- Generational wealth transfer: For families interested in passing on their wealth to future generations, we help develop and implement a succession plan to smoothly transfer assets and values.

- Lifestyle management: We assist with various personal and lifestyle matters, including travel arrangements, property management, and concierge services, freeing up your time to focus on other priorities.

- Proprietary access: We often have access to exclusive investment opportunities and networks, which can provide additional avenues for wealth generation.

- Risk management: With significant wealth comes increased exposure to risks. We help assess and mitigate these risks through insurance and other risk management strategies.

- Philanthropic endeavors: If you are interested in charitable giving, we help you establish and manage charitable foundations or trusts to support your philanthropic goals effectively.

- Family governance and education: We assist in establishing family governance structures to foster communication, address conflicts, and promote financial education among family members.

Alleviate Your Workload With a Skilled Family Office

At Interchange Capital Partners, we understand the unique challenges faced by affluent families, and our comprehensive range of services is designed to alleviate burdens and help your family plan.

Our experienced family office can be your partner in a complex wealth management environment. We combine a deep understanding of the complexities of trust and entity structures with in-depth knowledge of the four active interchanges within a successful family: the individual, family, business, and ownership.

By addressing these various aspects, our family office aims to streamline the complexities associated with significant wealth, enabling you to focus on your long-term objectives and well-being. Our family office’s specific services vary depending on your family’s unique needs and preferences.

By partnering with us, you can focus on what truly matters, confident in the knowledge that your wealth is managed with precision and integrity. If you’re looking for a personal, trusting partnership, please take advantage of our Second Opinion Service. Email us at

team@interchangecp.com or call our office at 412-307-4230 to schedule an introductory appointment.

About Ahmie

Ahmie E. Baum is the CEO and Founder of Interchange Capital Partners. Using a collaborative and comprehensive process developed over 43 years of working with wall street banks and financial services firms on behalf of families.

Interchange Capital Partners provides family office and transition strategy services for family businesses, helping families protect and grow their family capital with clarity, understanding, and action by being relevant and resourceful around their unique circumstances.

As a graduate of the University of Pittsburgh, Ahmie began his career with EF Hutton in 1979 and transitioned to UBS in 1993. Ahmie is a CERTIFIED FINANCIAL PLANNER™ (CFP®), received the Executive Certificate in Financial Planning from Duquesne University School of Leadership and Professional Advancement and has a Certificate in Family Business Advising (CFBA) from the Family Firm Institute. He also has Certificates from The Growth Institute around Growing and Scaling Business and Cash Management. For the past 20 years, he has been involved with Strategic Coach, an international entrepreneurial training program

When he’s not working, Ahmie enjoys spending time with his wife, Sara, their three children, and their granddaughters. He recognizes that health is wealth so he has committed to daily yoga, meditation, and plant-based eating. His other hobbies include woodturning, golf, reading, listening to music, and biking. He is active in his community and served as the Foundation Chair of the Jewish Federation Community Foundation of Greater Pittsburgh and supports the Big Brothers Big Sisters of America (BBBS). To learn more about Ahmie, connect with him on LinkedIn.

Interchange Capital Partners, LLC, (“INTERCHANGE CAPITAL PARTNERS”) is a registered investment adviser with the Securities and Exchange Commission providing investment advisory and financial planning services. Any reference to the terms “registered investment adviser” or “registered” does not imply that INTERCHANGE CAPITAL PARTNERS or any person associated with INTERCHANGE CAPITAL PARTNERS has achieved a certain level of skill or training. A copy of INTERCHANGE CAPITAL PARTNERS’s current written disclosure (ADV 2A Firm Brochure) discussing our advisory services and fees is available for your review upon request. INTERCHANGE CAPITAL PARTNERS, in addition to providing investment advisory and financial planning services, provides business consulting services. In connection with its business consulting services, INTERCHANGE CAPITAL PARTNERS does not provide tax or legal advice.

This material is proprietary and may not be reproduced, transferred, modified, or distributed in any form without prior written permission from INTERCHANGE CAPITAL PARTNERS. INTERCHANGE CAPITAL PARTNERS reserves the right, at any time and without notice, to amend, or cease publication of the information contained herein. Certain of the information contained herein has been obtained from third-party sources and has not been independently verified. It is made available on an “as is” basis without warranty. Any recommendations, projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.